Senior Direct Tax Specialist

- Recruiter

- Bridgestone SSC in Poznań

- Location

- Poznan

- Salary

- PLN

- Posted

- 22 Jan 2022

- Closes

- 22 Feb 2022

- Approved employers

- Approved employer

- Job role

- Accountant, Tax

- Contract type

- Permanent

- Hours

- Full time

Senior Direct Tax Specialist

Position Snapshot

- Type of Contract: Permanent

- Full-time

- Location: Poznań

The Company:

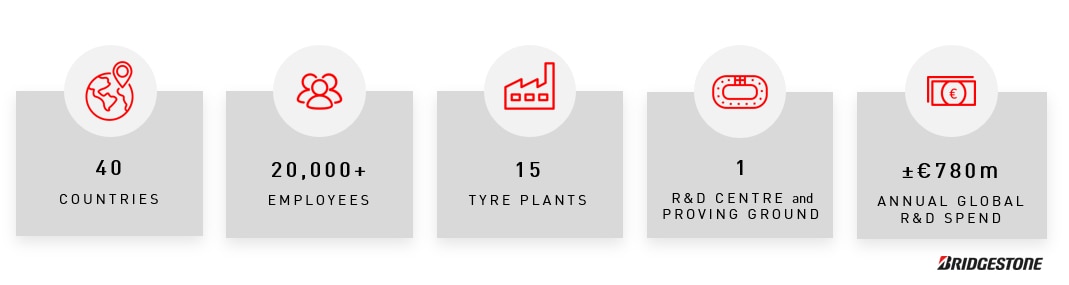

Bridgestone in Europe, Russia, Middle East, India and Africa (BSEMIA), headquartered in Zaventem (Belgium), is a subsidiary of Bridgestone Corporation, a global leader providing sustainable mobility and advanced solutions.

In addition to our premium tire products, we offer a growing portfolio of tire-centric and mobility solutions. Together with our partners and guided by "Serving Society with Superior Quality”, that has been our mission since Shojiro Ishibashi founded Bridgestone in 1931, we are working to accelerate sustainable mobility innovations and solutions. Through innovative technology, we are committed to easier, safer, smoother and seamless mobility for our society and customers improving how people move, live, work and play .

Bridgestone also benefits from a significant retail network throughout the region – in fact our retail presence in the EMIA region is the largest in the tire industry. Through 17 distinct retail partners, we have around 3,500 outlets across Europe, the Middle East and Africa as well as around 2,500 outlets through our partner network in India. This network offers a selection of services, concepts and mobility solutions.

At Bridgestone we pride ourselves on the strong relationships we maintain with everyday drivers and this extensive retail network is one of the core reasons why.

Bridgestone EMIA

In line with the “Bridgestone Essence”, our work environment is based on integrity and teamwork, where everyone can learn from each other and contribute with their own ideas in achieving the coming goals.

We want to hear from people who can take the challenge, unleash their creative potential and contribute to the company success demonstrating ownership, courage and agility. We want you to develop your skills, expand your knowledge and be proud of your work.

Responsibilities:

- Acting as subject matter expert for direct taxes according to polish tax law

- Prepare tax data for CIT, WHT, DIT, required by polish law, singing of declaration

- Support quarterly and annual corporate reporting for income tax process

- Analyze tax data, check accuracy, trends and spot discrepancies

- Support with preparation of Statutory Financial Statements, especially Tax Notes (current tax and deferred tax)

- Ensure tax related payments to government / tax authorities are executed as per the timelines

- Monitor latest tax changes/amendments

- Closely work with Bridgestone Global Tax team, Local Finance teams, SSC teams on ongoing tax compliance for Bridgestone companies in Poland

- Supporting business operations in assessing tax impact of their business decision

- Supporting company on more complex CIT, WHT projects together with other business areas

- Supporting verification and control over balance sheet reconciliations

- Driving process improvements and promote best practices in the tax area

- Delivering internal tax trainings to finance and business team

- Leading activities during tax audits and litigation by providing relevant information to country tax teams

- Ensure archiving of relevant tax documents and being responsible for updating process documentation

Requirements:

- Relevant Tax, Economic or Accounting University Degree -Tax specialization preferable

- Tax Advisor/Chartered Accountant certificate is a distinct advantage

- Minimum 5 years of progressive experience in tax accounting, tax compliance or tax advisory or as an in-house advisor

- Strong understanding of the Polish tax legislation and government systems

- Must be a self-starter with proven ability to take ownership of job responsibilities

- Very good awareness of accounting principles

- Excellent English communication skills in verbal and written required

- Ability to work independently and proactively, highly organized with the right level of focus on details

- Good knowledge of MS Office (in particularly Excel)

- Knowledge of SAP as an advantage

- Excellent interpersonal skills - ability to communicate with both finance and non-finance staff at all levels

- Ability to work in an intense, fast paced and multinational work environment

Why should you apply?

- Bridgestone as a global company drives your career to the next level by offering you possibilities to work in an international setting.

- You will have the opportunity to experience a dynamic and challenging environment and work on different and innovative projects.

- We offer you attractive Benefits and a Competitive Salary

If you can demonstrate the skills we are looking for and would like to make a difference in a Pioneering company dedicated to shaping a sustainable future of real-world mobility solutions, join us at Bridgestone!

Process Next Steps: All applications will be reviewed. Our HR team will contact those applicants who we would like to invite for the next stage of the recruitment process.

Please don’t hesitate and apply at https://careers.bridgestone-emea.com/

We are looking forward to hearing from you!

You can learn more about our Group and reasons to join us on

Follow us on social media:

Disclaimer

Diversity and inclusion are a central part of Bridgestone EMIA’s values at the highest level. This is key for our people to show a passion for excellence for improving society connected to the world in which we live. Our commitment to diversity, is linked to our founders mission of ‘Serving Society with Superior Quality’, which is essential in shaping and creating the organization, serving all people, respectfully, connected to our business. We recognize that everyone is different and that attracting, developing and retaining our employees will create a sustainable working environment which is essential to our success. This means that all job applicants and members of staff will receive equal treatment and that we will not discriminate in particular on grounds of gender, marital status, race, ethnic origin, color, nationality, national origin, disability, sexual orientation, religion or age.